hawaii capital gains tax rate 2021

Increases the capital gains tax threshold from 725 to 9. The capital gains tax is imposed on the profits from sales of capital assets such as houses stocks bonds or.

Capital Gains Tax Calculator 2022 Casaplorer

While the federal government taxes capital gains at a lower rate than regular personal income states usually tax capital gains at the same rates as regular income - this is not the case in.

. The 2022 state personal income tax brackets are. Short-term capital gains come from assets held for under a year. Before the official 2022 Hawaii income tax rates are released provisional 2022 tax rates are based on Hawaiis 2021 income tax brackets.

Hawaii also has a 440 to 640 percent corporate income tax rate. The tax rate for Oahus new Bed Breakfast Home category is 650 per 1000 assessed value. Hawaii has a 400 percent state sales tax rate a 050 percent max local sales tax rate and an average combined state and.

Based on filing status and taxable income long-term capital gains for tax year 2021 will be taxed at 0 15 and 20. 7 rows Hawaii. 1 increases the Hawaii income tax rate on capital gains from 725 to 9.

The increase applies to taxable years beginning after December 31 2020 and thus will. Increases the alternative capital gains tax for corporations from 4. If you make 202170 a year living in the region of Hawaii USA you will be taxed 63376.

That applies to both long- and. Under current law a 44 tax rate is imposed on taxable income less. The 2021 state personal income tax brackets are.

Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. This new BB Home property tax rate will apply to properties obtaining new. Complete Edit or Print Tax Forms Instantly.

Hawaii Income Tax Calculator 2021. Hawaiis capital gains tax rate is 725. This is your long-term capital loss carryover from 2021 to 2022.

If you are eligible as an owner occupant you may claim your Home Exemption by September 30 2021 but only if the property is your primary residence. Raise Revenue Tax Fairness. Your average tax rate is 2053 and your marginal tax rate is.

Capital gains are currently taxed at a rate of 725 Inheritance and Estate Tax and Inheritance and Estate Tax Exemption Generally only estates worth more than 5490000. If zero or less enter zero. Ad Access Tax Forms.

Before the official 2021 Hawaii income tax rates are released provisional 2021 tax rates are based on Hawaiis 2020 income tax brackets. The bill would increase the tax on capital gains to 11 from 725 and increase the corporate income tax rate to 96.

What Is Capital Gains Tax And When Are You Exempt Thestreet

Capital Gains Tax What Is It When Do You Pay It

Sally Kaye Gov Ige Should Veto Sb 2510 It S An Embarrassment Honolulu Civil Beat

Capital Gains Tax What Is It When Do You Pay It

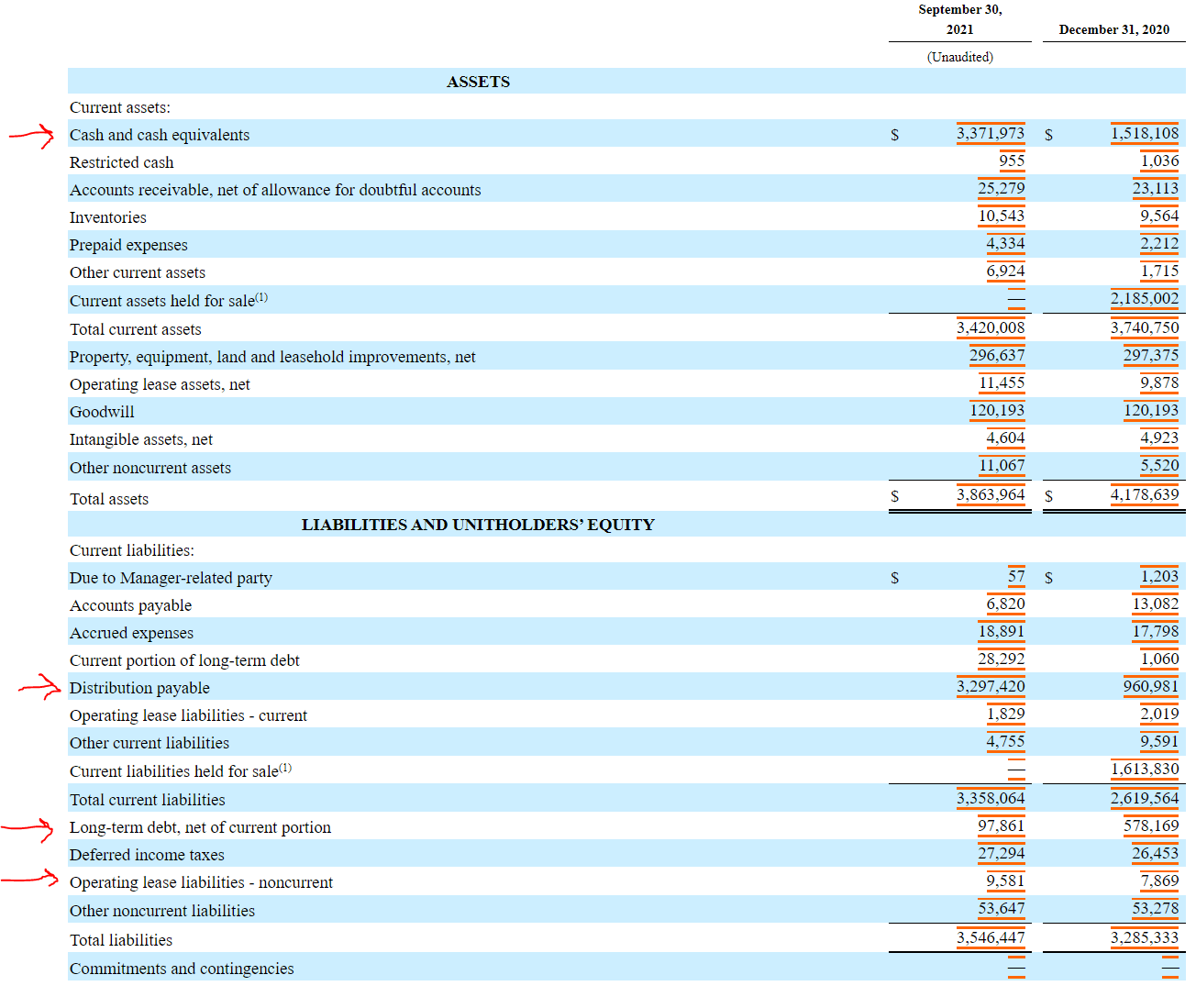

Macquarie Infrastructure Might Reload But Will Compete Fiercely In Allocating Nyse Mic Seeking Alpha

Contact Congress Stop Elimination Of Step Up In Basis Proposal Policy And Taxation Group

States With The Strongest Unions 2021 Edition

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

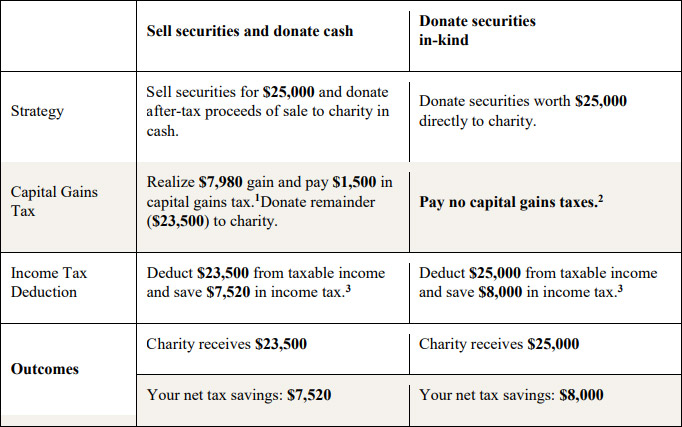

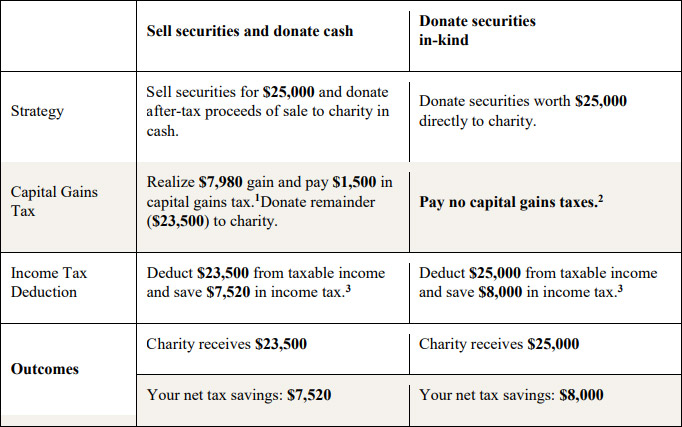

Other Donation Opportunities Preschool Advantage

Washington State Enacted Capital Gains Tax Currently Held To Be Unconstitutional 2021 Articles Resources Cla Cliftonlarsonallen

How To File Taxes For Free In 2022 Money

Did You Invest In Crypto Last Year Here S What You Need To Know About Filing Your Taxes In Hawaii